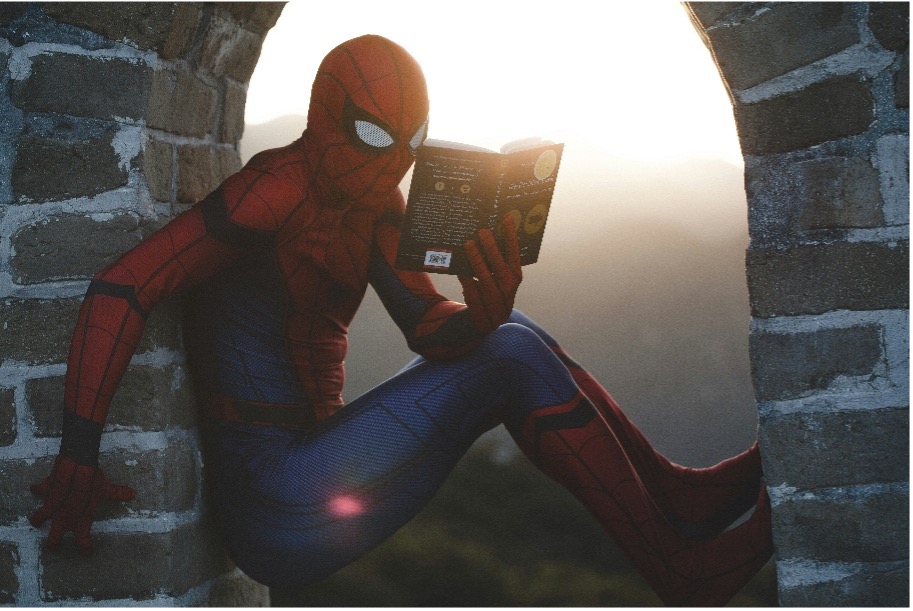

“With great power comes great responsibility.” Peter Parker (aka Spiderman)

What do Laxman Narasimhan of Starbucks, John Donahue of Nike, Mark Schneider of Nestle, and Fabrizio Freda of Estée Lauder have in common? They’re all CEO’s of companies turning over billions of dollars each year. Their combined overall turnover in 2023 was over 200 billion dollars. And, as Spiderman (almost) said – this means they have a responsibility to their shareholders to grow their business and the best way to do this is to put the customer first.

Starbucks has changed the way millions of people consume coffee worldwide. We may not all agree that it’s been for the better but there’s no doubt that its impact has been massive. Nike revolutionised footwear. I’m sure many of the people reading this will have previously read Phil Knight’s autobiography ‘Shoe Dog’, an excellent read as it shows all the highs and the lows of starting a new business. Nike moved footwear from the functional realm to an emotional one in my opinion. Nestlé is a behemoth, bestriding so many different categories across most markets. If you haven’t already consumed a Nescafé product today, chances are you will before the day is out. Estée Lauder, I’ll admit, of the four brands is the one I’m least familiar with. However, one would have to be hiding under a rock not to realise the commercial importance of a brand such as Estée Lauder for the last 80 years.

Their turnover for 2023 was as follows:

Another thing these CEOs have in common is that they have either been asked to step aside, have resigned, or have told their boards of management that they plan to do so in the next fiscal year. Recently, an article in The Grocer magazine, written by Warren Ackerman, posited that the reason for their resignations was that they had failed to stay ahead of the curve – to understand where their customers were coming from and most importantly where they’re going. In starker terms, their companies had become stale because they were not on top of consumer trends.

That old chestnut? Anyone, who has been reading the various pieces I have written over the last year (thankfully quite a few of you – cheers), will know that I am an enthusiastic fan of keeping things simple. I don’t think it gets any simpler than speaking to your customers and your competitors’ customers and understanding how they’re behaving, what they are doing the same as before and what is different, and how this applies to your perceived competitive advantage. Keep your customers close.

However, I am also not so naïve as to not understand that when big companies get moving, they can be hard to redirect. Like big ships, it takes planning and cajoling of certain levers and key players to make change happen. For this reason, customer closeness needs to be part of the fabric of every business. It needs to be the everyday. We can’t get surprised when consumers start to behave differently – or at least we shouldn’t. Outside forces will happen and impact your consumer’s thoughts and wallet and you need to be ready.

The years 2019 to 2024 have been far from normal. Covid kicked it all off in late 2019 and early 2020. This led to unprecedented changes in economic behaviour as people cocooned in fear at home and bought far too much toilet paper. Supply chain issues from the Covid hangover as well as from the horrific wars in Ukraine and more recently Gaza and Lebanon have further impacted not just what consumers buy but what they are able to buy. In the middle of these two book ends were hyperinflation and increasing ECB interest rates. The response to this from many FMCG companies was to increase prices or engage in shrinkflation (I’m looking at you Yorkie). However, it seems that now, maybe, just maybe, things are starting to settle and big FMCG companies can start to flex a bit of creative muscle and create new products that customers want.

These companies might ask “How will I know we are ready to take this jump? This leap of fate” (Spiderman). Is it tough? Being ready for this potential period of expansion is a cultural challenge, in my opinion. Companies must accept that even in times of relative stability there will be change. What is surprising when we look at the list of the CEOs mentioned already is that we would have expected these companies to be at the forefront in terms of FMCG companies and have cultures that encourage customer engagement but that hasn’t turned out to be the case.

Even when companies openly talk about a customer culture, typically to placate and excite shareholders rather than their consumer base, the way they talk about this can change – but it is always there. Not having a customer-first culture is not an option – unless you want to miss trends, the opportunities trends create and go the way of John Donahoe and the other CEOs. Let’s take Unilever for example. In 2009, Paul Polman was appointed CEO, and he made a bold statement – “Every brand that Unilever owned would have a social purpose.” A reason to exist beyond profit and building shareholder wealth. This was what customers wanted at the time and Unilever set themselves up to deliver. Unilever’s first product, Lifebuoy soap had been designed to help combat cholera in England in Victorian times so Mr. Polman’s idea had heritage. And he was true to his word. Paul Polman’s successor, Alan Jope, went one step further claiming that any brand that had no social purpose would be sold off. Or in his words.

“We will dispose of brands that we feel are not able to stand for something more important than just making your hair shiny, your skin soft, your clothes whiter or your food tastier.”

Did they follow through with this? Kind of. During the period that it was being demanded by customers Unilever were very good at this. They set about buying brands that were purpose-driven (e.g. Pukka tea, Dollar shave club), shouting about brands that they already owned that wore their purpose on their sleeve (Ben & Jerrys and Dove for instance) and retrofitting purpose back into some brands that had forgotten what their purpose was e.g. Hellmann’s. Perhaps more impressively they sold off a whole part of the business that they didn’t think met the measure in terms of social purpose – so long Flora and I can’t believe it’s not butter. What happened next is what’s important.

Unilever had steadied the ship and now had a full repertoire of purposeful brands, but the business never stopped listening to its customers. Social purpose, like any trend, had been tested and seen to be important but its importance waned. It was not quite a hygiene factor but something more was required. Jope stepped down in 2023 and Hein Schumacher took on the role of CEO. He has continued to listen to Unilever’s customers and is now following a strategy of “unmissable superiority”. As he describes it “We’re looking at, in total, 21 metrics behind these 6 Ps [product, packaging, proposition, promotion, place and price]”. He is also reducing the company’s exposure to the food industry (and all its sensitivities) and going harder in cosmetics and wellbeing. It’s clear that when companies listen to their customers, they are better positioned to take advantage of the rising tides and chuck whatever is not working overboard.

The Yin to Unilever’s Yan, P&G are similarly following a strategy of “irresistible superiority” – perhaps both hired the same management consultant but these strategies sound very similar! It’s probably no surprise as they are targeting the same customers with many of the same types of products so the insight that is revealed should be similar and consistent. P&G have gone one step further and have proclaimed that only 30% of their portfolio is “irresistibly superior”. They used to say 80% of their portfolio was. Cue frantic Brand Managers checking out the levers required to hit the measure and making the necessary changes to their brands. The system works.

One other industry where we see very successful systematic customer closeness is Fintech. The mainstream banks, have for the main part, been caught napping. Fintech brands such as Monzo and Revolut have listened to what customers want and given it to them. They’ll only ever be a lifestyle bank – people won’t be getting Revolut/Monzo mortgages – I’m paraphrasing what I have heard senior bankers utter in the not-so-distant past. Then, in 2022, Revolut started offering personal loans in Ireland and next year they will offer mortgages. They listened and they are delivering.

Our final example is the grocery trade. Those of us working in the FMCG trade in the early 2000s looked on in bemusement as ‘the discounters’ (as we rather arrogantly called them) started to open stores. Seen as a ‘less than’ alternative to the multiples such as Tesco, we all believed (hoped?) they would not increase penetration beyond 10% levels. In the UK, Aldi and Lidl now have 18% of the market and are growing rapidly with Aldi bigger than Morrisons and Lidl not far behind. In Ireland that combined share is 25.5%. Tesco is 23.5%. The people spoke, Aldi and Lidl listened, and they are reaping the rewards.

So, what’s next?

We have spoken about companies as different as Nike, Aldi, Unilever and Revolut. Not all companies are created equally. History tells us that the ones that build systematic customer feedback and engagement into their DNA are the ones that will succeed. As soon as that link is broken, share will start to decline and as we have seen, heads will start to roll. There are various emerging trends such as the growth of AI, Phygital in retail, plant-based foods, especially protein. Companies must stay on top of the trends because chasing a trend is a lot more difficult. Or to put it simpler, lead rather than follow because as Spiderman says – with great power comes great responsibility – that is the brand owners gift and its curse – (I am paraphrasing)

Lead by keeping your customers and your competitors’ customers close. Listening to them and creating a culture of insight in your business. This is why we developed LifeStars. LifeStars is the customer closeness app that helps brands create simpler, quicker, and more cost-effective research plans.

If you would like to know more about how LifeStars can work for your brand, please contact hello@lifestars.com. Let’s bring your customers close and create truly effective brands built on common values and long-term goals. Sound interesting? Get in touch today.