It all started in what we now call Türkiye, approx., 9000 years ago.

People started to trade for products and the retail industry was up and running. Since then, a lot has changed, and most of that change has occurred in the last 30 years or so with the emergence of technology. Stalls became stores. Stores got bigger. Barter gave way to coins, which were accompanied by credit and now we trade online by clicking buttons. Crypto sits on the sidelines ready to make an impressive entrance. Stores have moved online, and whilst many have closed some of their physical stores, now it seems that consumers like physical stores again. So where does that leave retailers? In an ever-changing environment, how can they know where to invest and what the future looks like? Let’s take a look and see if we can help.

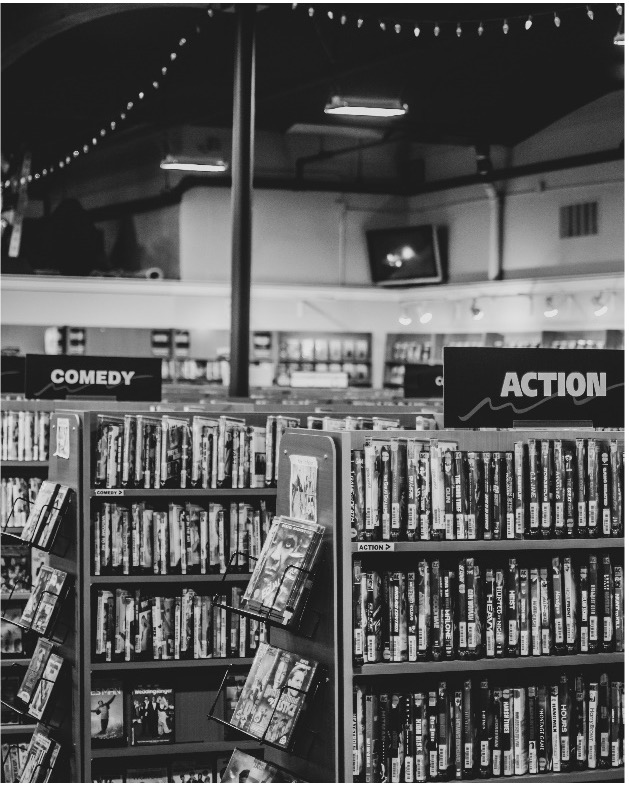

If, like me, you grew up in the late 20th century you will remember, (probably with a mix of wistful nostalgia and perhaps even some joy), the feeling of going to the local video store to rent a VHS tape, a DVD or even a games console bundle when they emerged. It required planning and was often a group activity. Renting a movie entailed walking the aisles of a video store and perusing the shelves like many now might use their Tinder apps. Swipe your eyes left “seen it”, swipe right “looks good”. Then there were the associated treats. Pick up a movie but also some popcorn, sweets or maybe a pizza. As you got older this meant beers and so on. Picking a movie was a multi-faceted retail experience involving your family and/or friends, multiple stores, travel, and a lot of decisions.

Now what do we do? Tadum – you’re on Netflix.

Where the shelves have been replaced with line after line of carefully curated movies. So now rather than spending 30 minutes walking around your video store, you can spend 30 minutes trying to decide which movie, of the thousands at your fingertips, you’d like to invest your time in. Is this progress?

Before we answer that question it’s important to note that for many the question is redundant. If you were born in 2006 and have just turned 18 then Netflix has been a constant companion, with Netflix streaming launched in 2007. 10 years prior to that was the real genesis of new-age retail, when Amazon launched on July 5th, 1994. Amazon claimed to be ‘the world’s biggest Book store’ but as we all know it wasn’t books that made its billions – it was the shift to selling literally everything else! Amazon founder, Jeff Bezos was named TIME Person of the Year in 1999 for “popularising online shopping”.

If you asked the average retailer in 1999 what the future looked like, they would have shown you a computer screen and said dive in. It all appeared that way. 1 year later the dot.com bust left many burgeoning online retailers on their knees, but they would eventually come back stronger. Then 20 years later their real boom came during the Covid-19 pandemic. Consumers were a captive audience with nothing but their laptops and phones and their immediate family to keep them company. Amazon exploded in popularity, and it looked like the final nail in the bricks-and-mortar retailer’s coffin had finally been put into place and hammered home.

So now, 25 years after those same retailers pronounced the future was online would they say the same? Jeff Bezos is worth approx. 200 billion dollars, Amazon does over 400 billion of sales per annum, eBay accounts for approximately 10% of that at 40 billion. Surely the future is clicks-and-importer rather than bricks-and-mortar?

Consumers have a way of bucking trends and keeping retailers on their feet.

The latest evidence suggests that physical stores haven’t gone away. Moreso, they have been busy regrouping and evolving to take the best bits of what they do (ah the countless hours looking through CDs in HMV) and adding in the best bits of the online retailers to create a Frankenstein’s monster that we all want to get to know. He is currently called Phygital (Physical + Digital) but that’s likely just a transition – the truth is bricks-and-mortar stores are back to growth and the data proves it!

-

- Globally, brick-and-mortar sales totalled $20.8 trillion in 2023 up 4.00% YoY. (Source: Capital One)

-

- Since the Covid-19 pandemic, evolving omnichannel strategies – where e-commerce complements physical store performance and visa-versa, is resulting in the prioritisation of store portfolios by retailers. (Source: Savills)

-

- Abercrombie & Fitch beat expectations with a 22% jump in sales in its first fiscal period, compared with a year earlier. (Source: Axios)

-

- Physical stores will account for 76% of worldwide retail sales in 2028. (Source: Forrester)

-

- Gen Z shoppers in the USA, prefer in-store shopping, which accounts for almost 78% of their total spend. (Source: Logiwa)

Key Takeout:

If you thought bricks-and-mortar was gone and in continuous decline, you’re wrong. However, physical stores are changing. Understanding what your customers want from their retail experience, both offline and online is essential. “Retailers such as Abercrombie, American Eagle and Foot Locker are all reaping the rewards of strategies that are focused on the consumer,” (Neil Saunders, Retail Analyst – GlobalData).

The comeback of brick-and-mortar stores is based on a data-driven strategy. Retailers are researching their customers to better understand their behaviour, preferences, and buying patterns. By gathering and analysing this data, they can fine-tune in-store experiences to cater to their target audience. Keep your customers close.

How are physical stores pushing back?

Surely the benefits of scrolling on your phone to choose your latest purchase outweigh having to go out in the real world and see other people? So why are physical stores making a come-back? Here are 5 reasons why:

1

Often the in-store experience is better.

All consumers enjoy an engaging retail experience, and the fact remains that being in a store stimulates the senses more than browsing online. Take your typical Apple Store. People enjoy playing with the latest iPhone. In Dyson stores, consumers want to see how well the new Dyson vacuum compares to the last one, or what the new Dyson Airwrap does for your hair. Even with less involved purchases, the experience is just better in-store. Buying a bottle of wine? Don’t tell me you don’t enjoy the little recommendations left by staff in lots of off-licences. Of course you do. And you probably think your wine tastes better as a result too!

However, Showrooming can be an issue. This is when a customer uses the physical store to examine products and to ask the staff questions but then they go home and purchase the product online, often elsewhere. It’s easy to say that this is the customer’s fault but perhaps better to understand why they do this. No, it’s not always down to seeing a cheaper price online.

Key Takeout:

As a retailer, your job is not to educate the customer so they can purchase somewhere else, especially from an online competitor. Work with your customers to understand the factors that will encourage them to part with their hard-earned cash in your store. Keep your customers close.

2

Shopping in-store is easier than it used to be

Particularly when it comes to payments. Stores have learned the hard way and almost all will allow you to tap, swipe, show them your watch to pay for your purchases – although a recent trip to Germany showed me that I definitely see the world through Hiberno-UK-US glasses; cash is still definitely king in lots of establishments*. This ‘tapability’ means paying for purchases can almost feel like not paying at all – this is to the customers benefit as it is quick and easy and likely benefits the retailer too as the easier it is the more we spend.

* The data confirms this: In Ireland, 18% of transactions are cash, 72% card/digital wallets; in the UK that’s 10%/90% – Germany is 36% cash, 64% other, just behind Spain which is the most cash intensive European country at 38%. (Source: Worldpay – Global payments report)

Key Takeout:

A store that accepts cash only is not going to cut it. In fact, for different reasons it can really upset your potential customers with “potential tax evasion” and “no consideration for the customer” cited as gripes on forums such as Reddit. Talk to your customers and see what works for them. Make the payment process simple and maybe even a point of delight – see Decathlon in the next point.

3

The best physical stores have embraced in-store tech

The best stores have leaned into what technology can offer, and are offering a blend of the best of the new with the reassurance of the old – this is Phygital.

Let’s look at a few examples.

Decathlon – the large French sports retailer that is now in 78 countries worldwide. Typically, customers go in for a few items and buy more than planned (due to the huge range, clever merchandising, and value on offer). When it comes time to pay it’s just a case of putting all the products into a basket that somehow manages to scan the items in no time at all. It’s tech making customers’ lives easier. This is also a good example of the peak-end rule, in which you can read about in a recent blog I wrote here. Why have other stores not adopted this system? Tesco Clubcard customers will be familiar with the system where they can scan their products as they go, avoiding the need to check out at all. Whilst Amazon Go stores go a step further, as they champion walk-out shopping!

Other brands use technology to enhance the experience – think Guinness giving customers the ability to scan their images onto the head of a creamy pint. Sephora allows customers to ‘virtually try on’ their cosmetics products. Countless home improvement stores will build the customer’s ideal kitchen in front of their eyes using software in-store.

Key Takeout:

Tech companies are queuing up to help retailers integrate new and existing features into their stores. Ask your customers what would genuinely make a difference to their shopping experience and their opinion of you as a retailer. Test twice and buy once. Keep your customers close.

4

Bricks-and-mortar stores and more customer engagement

As the media landscape continues to become more fractured with multiple new players, it is increasingly difficult for brand owners to target their customers without buying a long list of media partners. Say hello to in-store entertainment!

Walmart Connect has kicked this off but expect to see Tesco TV, Asda Advertising and Morrisons Media. Walmart claims that it serves over 90% of US households. Let’s take an example: the biggest selling US FMCG product last year was Coca-Cola (source: marketingcharts). As a brand manager of Coca-Cola selling in Walmart, I can now have my ads displayed on their app, on their website, at the tills when people are paying, on all of the TVs being sold in-store, on electronic shelf edge labels. They will also partner with influencers and host in-store events on big weekends such as The Superbowl. Walmart Connect’s tagline is ‘more than media, meaningful connections’. If done correctly, it’s easy to see how this strategy could pay off and enhance a customer’s shopping experience via entertaining and engaging content, carefully curated and delivered where it counts. Of course, the risk is that it will be just more noise, but time will tell.

Key Takeout:

The aim is to be engaging in a positive way. Not annoying! Has anyone walked the aisles of a certain home retailer to be confronted by a video with a brash voice selling some new product that promises to change their lives! Don’t be that retailer. Talk to your customers and see what will improve their engagement and lead to more sales for you. Keep your customers close.

5

It’s the economy stupid. Online costs more than it used to

Another reason that physical stores are making a come back is the cost of doing business online. It may seem counterintuitive, surely it’s cheaper to throw a wide net out online and capture customers than it is to have them come through the doors of your store? Sometimes. Escalating customer acquisition costs are impacting e-commerce profitability for brands and retailers. In 2013, merchants lost on average $9 for every new customer acquired, but today merchants lose $29 – a 222% rise, (Source: SimplicityDX). “Customer acquisition cost is a massive challenge for brands and retailers. Some brands now find it cheaper to acquire new customers by delivering personalized paper catalogues to their homes rather than acquire them via digital advertising. This would have been unthinkable just a few years ago when marketing through digital channels was a bargain.” (Jordan Jewell Analyst in residence at VTEX).

The key factors driving up the cost of acquisition of customers are the reduction in the use of third-party cookies and increased consumer privacy legislation, most notably GDPR. Research highlights the critical role of obtaining consent from new customers, allowing brands to send marketing materials. In 2013, the average value of a repeat sale was £21; today it’s risen to £29, marking a 38% increase. Collecting first-party data, like customer contact information on brand websites, has become more important than ever. Retailers need to focus on the Customer Lifetime Value of every customer. Or more simply – retailers must do everything they can to create customer loyalty. A positive experience can turn customers into brand ambassadors who create more customers.

Key Takeout:

GDPR is a good thing. It protects your customers’ privacy and their right to opt in and out of retailer communication. So, ask them politely to opt in and then work with them to understand how you can improve what you do so they move from being customers to being ambassadors for your brand. Keep your customers close.

What does the future hold?

Nobody can know for certain, even though we can be pretty sure that it isn’t just a slow slide into an Amazon dominated future – physical stores matter. As with all things economic and to borrow a line from the economist, David McWilliams “to understand economics you need to understand people” – I think that the future will be defined by how retail makes us feel.

Online retail is primarily a functional experience and I believe (sample of 1!) that whilst that will suffice for many transactions, customers are primarily emotional beings that crave connection and belonging. Connection with the brands they buy (another shout out to Russel Belk’s work on the extended self-concept), the people they buy from (the retailer) and each other. The physical store is much better positioned to encourage this connection rather than vampire shopping at 1am on Amazon. Add to this the decline in traditional gathering places (see Ira Zepp’s “The shopping mall as a ceremonial center”) and the role of the store will be to bring people together over their purchases! Sounds grim? It needn’t be. Retailers, by working with their customers, can create immersive, experiential centres that customers are happy to be in and more than willing to pay for. Just ask the customers first. Keep them close.

LifeStars is the customer closeness app that helps retailers conduct simpler, quicker, and more cost-effective customer research.

If you would like to know more about how LifeStars can work for your brand, please contact hello@lifestars.com. Let’s bring your customers close and create truly effective retail brands built on common values, long-term goals, and positive relationships. Sound interesting? Get in touch today.